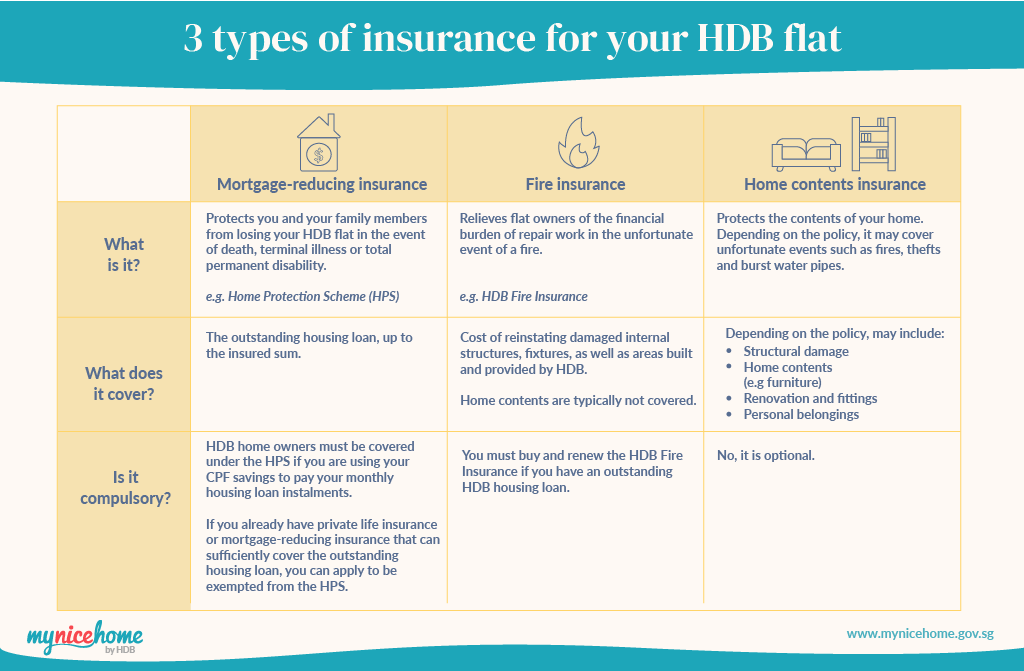

Just like how you would buy insurance policies to protect yourself and your loved ones, you can also buy policies to protect your HDB flat. Here’s what you need to know about the types of home insurance available for your flat.

Home Protection Scheme (HPS)

The HPS is a type of mortgage-reducing insurance, where the insured sum covers your outstanding housing loan. This type of insurance ensures that you and your family will not lose your home in the unfortunate event that death, terminal illness or total permanent disability affects your ability to pay for the flat.

If you use your CPF savings to pay for your HDB flat’s monthly loan instalments, you must be covered by the HPS . However, if you have life insurance or mortgage-reducing insurance from private insurers that can sufficiently cover the outstanding housing loan, you can apply to be exempted from the HPS.

The HPS will cover you until you are 65 years old, or until your housing loan is paid up (whichever is earlier). Note that you will only need to pay annual premiums for 90% of your HPS cover period. Your HPS premiums, which you can estimate using the HPS Premium Calculator, will be deducted automatically from your CPF Ordinary Account (OA).

If you had bought a flat from HDB and taken up an HDB loan to finance the purchase, you would have been guided on the HPS application process when you collected the keys to your flat. For resale flat buyers taking up an HDB loan to finance the flat, the application for HPS would have been done as part of the endorsement of resale forms and undertakings online via the HDB Resale Portal.

If you are taking a bank loan for your HDB flat, you must first apply for HPS on the CPF website before applying to withdraw your CPF savings for your monthly housing instalment.

Learn more about the HPS at CPF’s website.

Fire Insurance

This home insurance is meant to relieve the financial burden of repair work in the unfortunate event of a fire. If you have an outstanding HDB housing loan, you must buy and renew the HDB Fire Insurance for your flat. Even if you do not have an outstanding HDB loan, it is advisable to buy a fire insurance policy for your home, for protection against unexpected incidents.

The HDB Fire Insurance covers the cost of reinstating damaged internal structures, fixtures, as well as areas built and provided by HDB. Note that it does not cover home contents, like furniture, renovations, and personal belongings (more on that later).

The HDB Fire Insurance is valid for 5 years, and renewal is done once every 5 years. Here are the premiums and sum assured for each flat type:

| Flat Type | 5-Year Premium (Including 7% GST) Valid till 15 August 2029 | Sum Insured |

| 1-room/ Community Care Apartment | $1.11 | $37,900 |

| 2-room/ 2-room Flexi | $1.99 | $57,000 |

| 3-room | $3.27 | $83,300 |

| 4-room/ S1 | $4.59 | $117,000 |

| 5-room/ S2/ 3-Generation | $5.43 | $144,800 |

| Executive/ Multi-Generation | $6.68 | $176,700 |

| Studio Apartment | $1.99 | $57,000 |

You can buy or renew your policy with HDB’s current appointed insurer, Etiqa.

Home Contents Insurance

Want more protection for your home? This is where home contents insurance comes in.

Private insurers may offer insurance policies that cover your home contents. Depending on the policy, this may include renovation and fittings, home contents (e.g. furniture) and appliances. Remember to do your research to decide if you need an additional policy, before comparing and deciding on the best home insurance policy for your budget and needs.

Here’s a summary of the 3 types of home insurance:

Unfortunate events happen even to the best of us, and insurance can keep your home well-protected against the unexpected. Recently collected your keys to your new home? Check out more tips for moving into your new home or find your interior inspirations with our design ideas.