It’s never too early to think about retirement adequacy — in other words, how you can supplement your income during your retirement years. Beyond CPF monies, personal savings, and possibly investments, home owners can also choose to unlock the value of their HDB flats in their golden years. Depending on your needs and preferences, here are some ways you can monetise your HDB flat:

1. Continue living in your flat

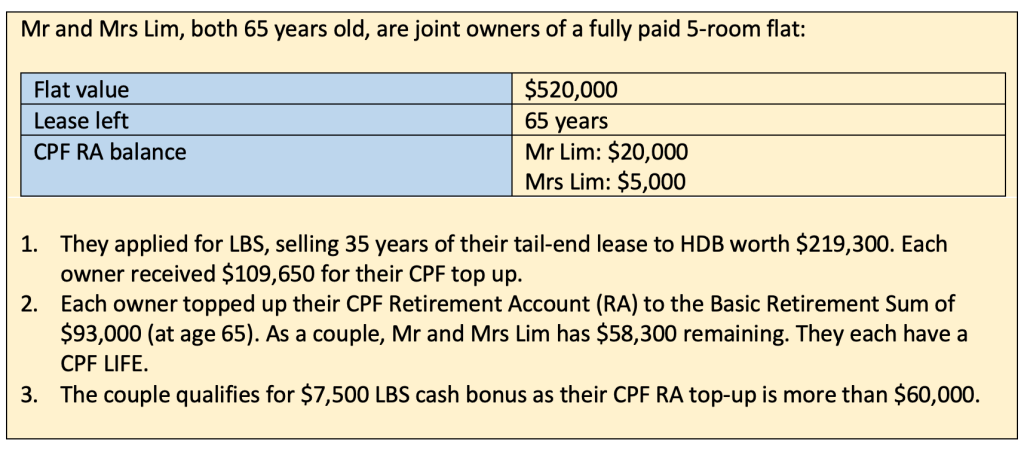

Mr and Mrs Lim, both 65 years old, chose to apply for the Lease Buyback Scheme (LBS) as they wanted to continue living in their existing flat. They received cash proceeds of $58,300, a monthly CPF LIFE payout of $1,090, and a cash bonus of $7,500.

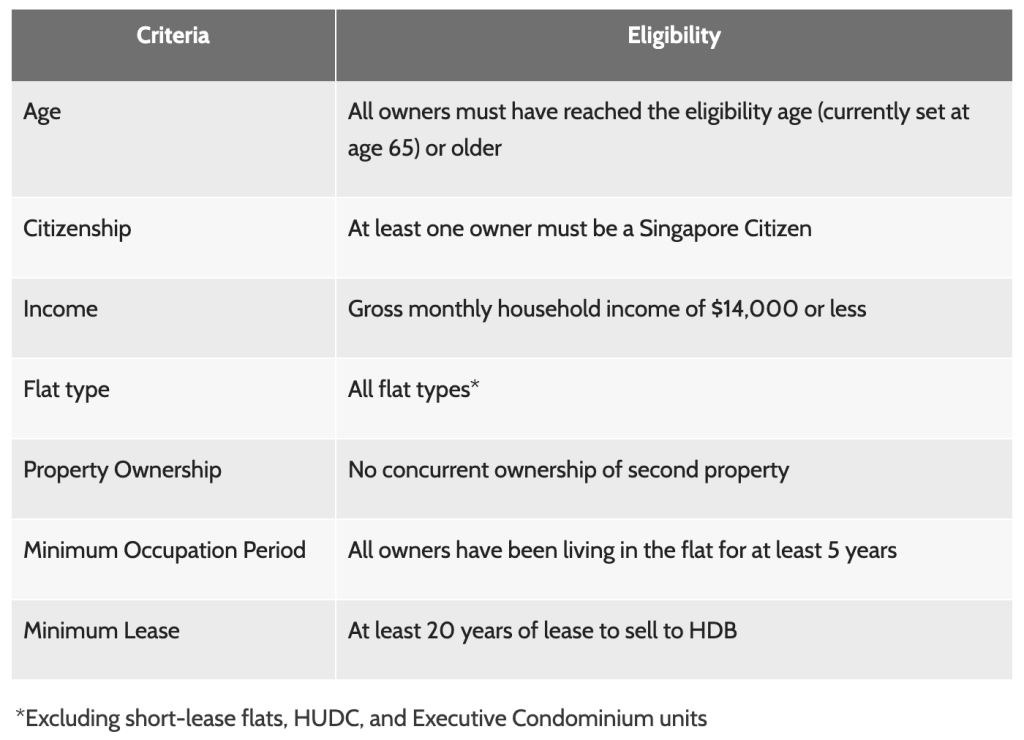

You can consider monetising your flat under LBS if you have fulfilled the minimum occupancy period (MOP). Interested? Check out the eligibility criteria for LBS below, or on HDB InfoWEB:

If you are younger than 65 years old, there is the option of renting out your spare bedroom(s) for income. Remember to submit an application to rent out your bedroom(s) through My HDBPage or Mobile@HDB before the commencement of the tenancy, and refer to CEA’s tenancy agreement template for HDB flats.

2. Moving out and purchasing a 3-room or smaller HDB flat

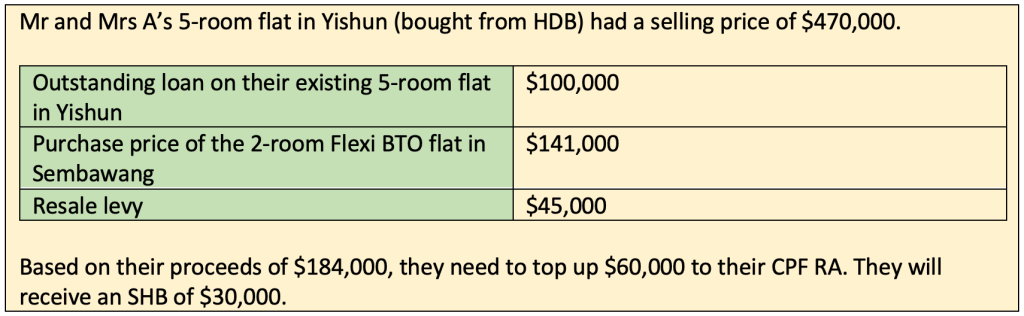

Mr and Mrs A sold their 5-room flat (bought from HDB) and bought a 2-room Flexi BTO flat. They qualified for a Silver Housing Bonus (SHB) of $30,000 on top of their proceeds.

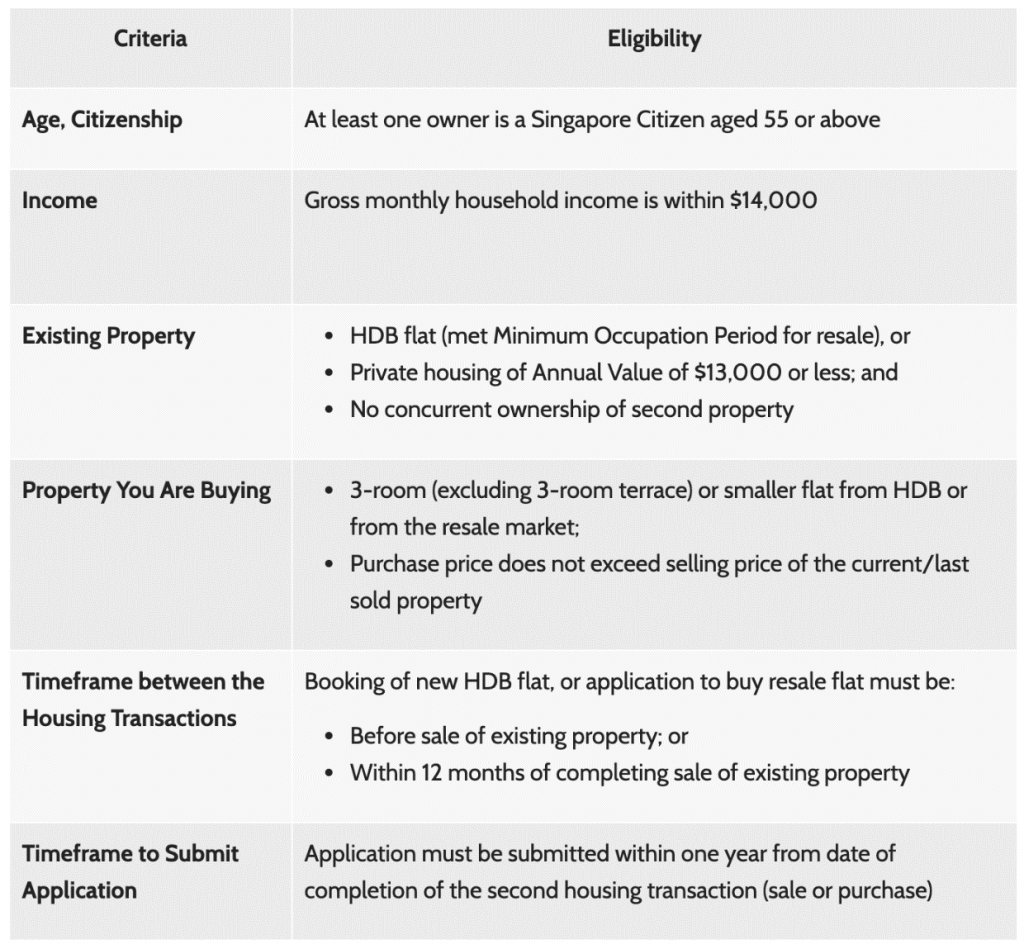

The SHB is applicable when home owners top-up their CPF RA with the proceeds of the sale. You can view the eligibility criteria below, or on HDB InfoWEB:

For the latest information on monetising your flat for retirement, visit HDB InfoWEB.

Bonus tip: If you do not need an additional source of retirement income but want to learn more about other elder-friendly housing policies, here are 5 things to know about the Community Care Apartments.