HDB will be offering more help for first-time Singaporean home buyers, whether they’re looking to buy a new flat (greater priority for those looking to set up their first home and start a family) or resale flat (more grants!).

A new category of buyers, First-Timer (Parents & Married Couples), or FT(PMC), has been introduced to help young families own a flat and settle down quickly. To qualify, you need to meet the following criteria when buying a Build-To-Order (BTO) or Sale of Balance (SBF) flat:

- Families with at least one Singapore Citizen child aged 18 or below; or married couples, aged 40 and below; and

- Never owned or sold a residential property before; and

- Did not have a chance to book a BTO/SBF flat in the past 5 years, before their flat application

1. What housing help will FT(PMC) get?

a) 3 BTO/ SBF Ballot Chances for FT(PMC)

Buyers under the FT(PMC) category will be given 3 ballot chances for their BTO/ SBF applications. This is an additional ballot chance on top of the two that first-timer buyers already receive. This will take effect from the next sales exercise in end September/ early October 2023.

Number of ballot chances for NME

| Applicant Category | Ballot chances in 1st and 2nd BTO attempt | 3rd attempt (for BTO in NME only) | 4th attempt (for BTO in NME only) |

| [New] FT(PMC) | 3 | 4 | 5 |

| Other First-Timer Families | 2 | 3 | 4 |

| Second-Timers | 1 | 1 | 1 |

b) Up to 40% of Flats in a BTO Exercise Set Aside under new FPPS

The current Parenthood Priority Scheme will be enhanced. Under the new Family and Parenthood Priority Scheme (FPPS), 40% of the public flat supply in each BTO exercise and up to 60% of SBF of flats in each SBF exercise will be set aside for first-timer families with at least one Singapore citizen child aged 18 and below or are expecting a child, as well as first-timer married couples aged 40 and below under the FT(PMC) category. This will take effect from the next sales exercise in end September/ early October 2023.

2. What help will I get as a first-timer if I do not fall under FT(PMC) category?

The bulk of HDB’s BTO flat supply is already set aside for first-timer families like yourself. First-timer families who do not fall under FT(PMC) will still receive double the number of ballot chances compared to second-timer families. Applying to BTO projects with lower application rates could help your chances in securing a home.

Additionally, first-timers receive up to $80,000 in CPF housing grants. In 2022, more than 80% of new HDB flat owners use less than 25% of their monthly income to service their HDB loan. This means that they could service their HDB housing loan using their monthly CPF contributions, with little or no cash outlay.

3. What happens if I had obtained a queue number as a first-timer, but decide not to book a flat?

Currently, if you are invited to book a flat but decline to do so twice, you will be deemed as a second-timer and lose your first-timer privileges for a 1-year period. These non-selection rules will be tightened from the next sales exercise in end September/ early October 2023, to prioritise applicants with more pressing needs to secure their new home.

- First-timer families, including those under FT(PMC) category, who accumulate one non-selection count will be considered second-timer families for a year

- Second timer families, seniors and first-timer singles who accumulate one non-selection count will have to wait one year before they can apply for a flat again

HDB will exercise flexibility to waive the non-selection count for applicants who at the time of their flat selection appointments, have 10 or fewer available flats to choose from in a BTO exercise; or 5 or fewer flats to choose from in an SBF exercise.

4. Tell me more about the $190,000 in housing grants for resale buyers?

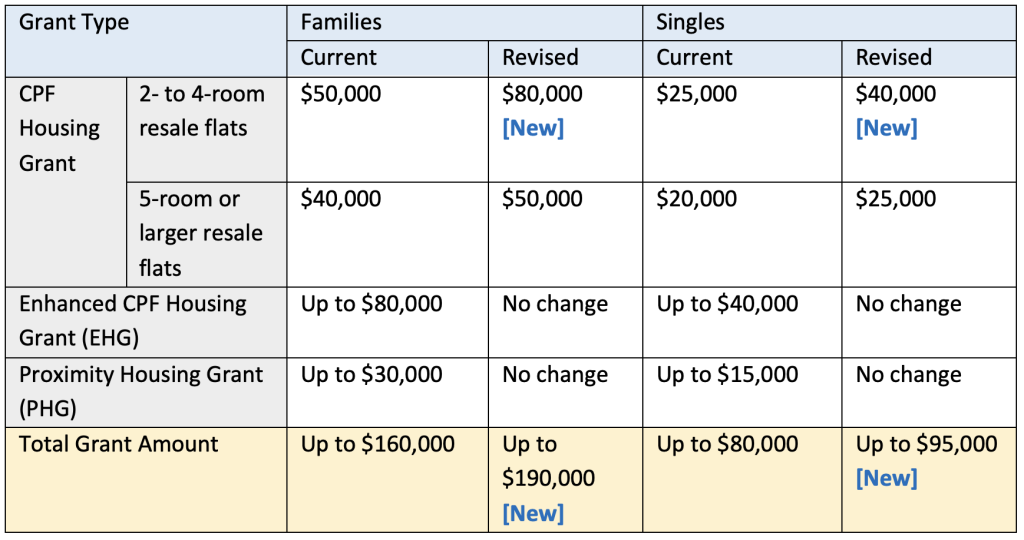

Currently, first-timers can get up to $160,000 in housing grants for a resale flat, or half this amount if you are buying as a single. This sum is made up of a few grant types, namely the CPF Housing Grant, Enhanced CPF Housing Grant, and Proximity Housing Grant.

To help make resale flats more affordable for first timers amidst the strong market, HDB will increase the CPF Housing Grant from $50,000 currently to $80,000 from 1st April 2023. With this, eligible first timers who wish to buy a resale flat will enjoy up to a total of $190,000 in grants.

5. I have a resale application that is being processed. Will I be eligible for the increase grant?

The increased grants of up to $190,000 will apply to eligible flat buyers who submit their resale flat applications to HDB from 1 April 2023. Eligible buyers who submit their resale applications from 14 February 2023 3:30pm to 31 March 2023, will automatically be extended the revising housing grant without any disruption to your resale completion. You will receive the difference between the increased grant and current grant within 3 months from the date of your resale completion.