My Build-To-Order (BTO) flat will be ready in a few years.

This gives me and my partner plenty of time to think about our future.

While it’s still early, the anticipation of living together in our own place has kept us going back to IKEA even though the sofas we’ve tried out may no longer be available by then.

Once in a while, I ponder about the decisions we’ve made for our BTO, especially since there’s still some time before we collect our keys.

Planning our finances

My BTO is the biggest purchase in my life thus far.

Despite this, I don’t think I did my sums carefully enough before trying to ballot for it.

I only considered how much loan to take on and my options for it when approaching the day to pay the down payment.

Did I consider the different interest rates of banks before deciding to go with a HDB housing loan?

I didn’t.

Not saying that I was reckless, but in hindsight, I could have been more thorough.

It wouldn’t have taken me much effort to do so, either.

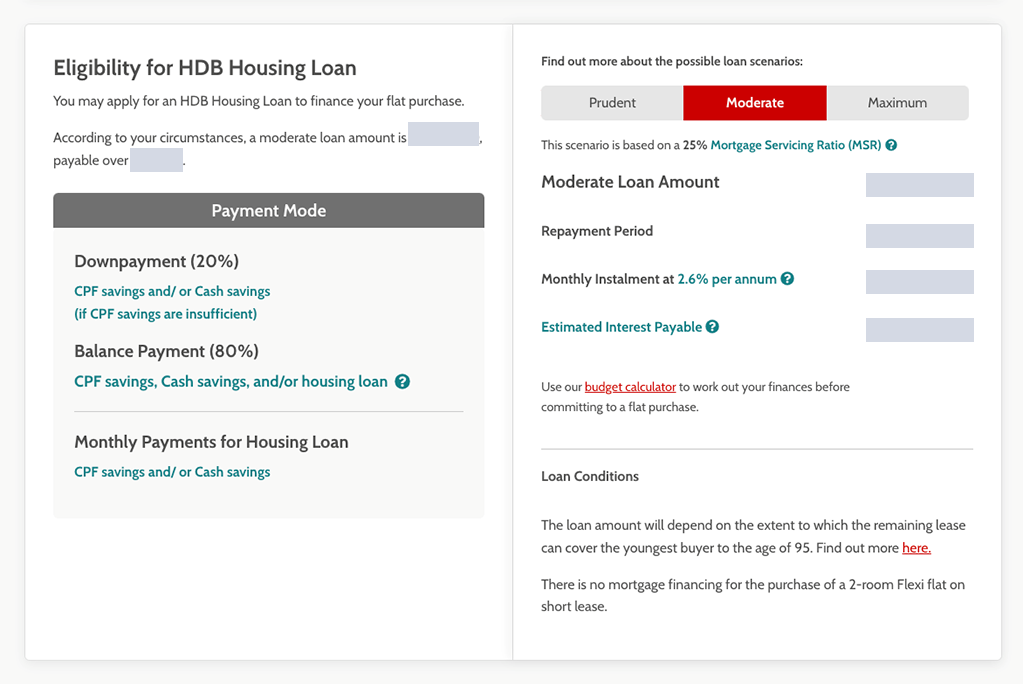

For starters, I could have keyed my CPF and cash savings into HDB’s budget calculator and churned out estimates for both HDB and bank loans.

According to my friend Rachel (not her real name), HDB now requires buyers to apply for an HDB Flat Eligibility (HFE) Letter before they embark on their flat buying journey.

I got curious and went to take a look at it.

The HFE letter provides an at-a-glance view of one’s eligibility to buy a flat, receive grants, and take up a housing loan.

These possible loan scenarios can help couples work out what loan amount to take up.

In the past, the assessment of one’s eligibility to buy a flat, receive grants, and take up an HDB loan was spread across the BTO application process.

I remember having to submit different documents at various stages of my application, and if I forgot to bring any documents, it would mean having to take another day off to meet the officer at HDB Hub again.

With the HFE letter, these various assessments are done upfront, which helps ease the flat-buying process.

Optional Component Scheme

Another thing I had second thoughts about when I bought my BTO was the Optional Component Scheme (OCS).

OCS items consist of things like floor finishes and sanitary fittings which you can choose to have installed in your booked flat.

My partner and I did not opt in for the OCS as we wanted the freedom to design the house as we liked.

Whenever I hear about renovation nightmares from others, however, I wonder if we made the right choice.

Is this ‘freedom’ worth the time and energy that my partner and I will have to spend on managing our home renovation in the future?

The biggest pro of OCS is the convenience of having more finishes and fittings ready for you and less to worry about.

My colleague Nigel shared the same sentiment:

“I wish I paid more attention to the OCS. I believe that with every new generation of flats, the OCS gets better and better.

My wife and I opted out because we thought that we would want to choose our own fixtures and flooring, etc.

We really didn’t give much thought to it and didn’t put aside time before booking our flat to go to HDB Hub to view the samples.

Now, I feel that if we had gone ahead with the OCS, we would have a simpler and faster renovation.

I wouldn’t say that I have any regrets, but I would definitely advise future homeowners to consider OCS carefully and see what works for them.”

Thinking about BTO-ing in 2024? Get your HFE letter first.

This year, HDB will launch approximately 19,600 BTO flats across three sales exercises in February, June and October.

These flats will be spread across a diverse mix of towns – including two BTO projects at Bayshore in Bedok, as well as new flats to be launched as part of the new Tanglin Halt Integrated Development.

Buyers will also have a shorter wait for their flats.

As we leave Covid-19 behind, the waiting times for new BTO projects have been reduced, with most flats having waiting times of four years or less.

HDB also plans to launch more than 2,800 shorter waiting time flats in 2024, which will have waiting times of less than three years.

For couples who are thinking about applying for a flat, be sure to get your HFE letter ready, as you will need one before a sales exercise.

It takes about a month, or longer during peak periods, for the HFE letter to be processed after HDB receives all required documents, and the letter will be valid for nine months.

Read more about the process of applying for an HFE letter here.

This article was first published on Mothership.