Note: The information in this article has been updated on 27 August 2024.

Thinking of applying for a BTO flat, but don’t know where to start? Here is a step-by-step guide to guide you on your BTO journey.

| Content |

| Step 1: Apply for an HDB Flat Eligibility (HFE) letter Step 2: Plan your finances Step 3: Look out for sales launches Step 4: Submit application Step 5: Receive application outcome Step 6: Book flat Step 7: Sign Agreement for Lease Step 8: Collect keys to flat |

Step 1: Apply for an HDB Flat Eligibility (HFE) letter

Before you begin, be sure to apply for an HFE letter through the HDB Flat Portal. You must have an HFE letter when you apply for a flat during a sales launch.

The HFE letter will confirm your eligibility to buy a flat from HDB, as well as the CPF housing grants and the HDB housing loan amount you can receive.

? First-timers buying BTO flats can receive up to $120,000 in grants – more in our guide to CPF housing grants.

If you wish to take a housing loan from a financial institution (FI), you may also concurrently apply for In-Principal Approvals (IPA) from participating FIs when you apply for an HFE letter.

Your HFE letter will be valid for 9 months.

? Typically, HDB will send you the HFE letter within 21 working days of receiving your complete application. However, the processing time is expected to be longer in the months of and before a sales launch – so apply early!

Learn more in our step-by-step guide on how to apply for an HFE letter.

Step 2: Plan your finances

With the housing and financing options in your HFE letter, you can already work out a budget for your flat – you don’t have to wait for a sales launch to start doing the math!

With HDB’s budget calculator, you can retrieve information from your approved HFE letter, and be guided through the process of calculating your flat budget.

Step 3: Look out for sales launches

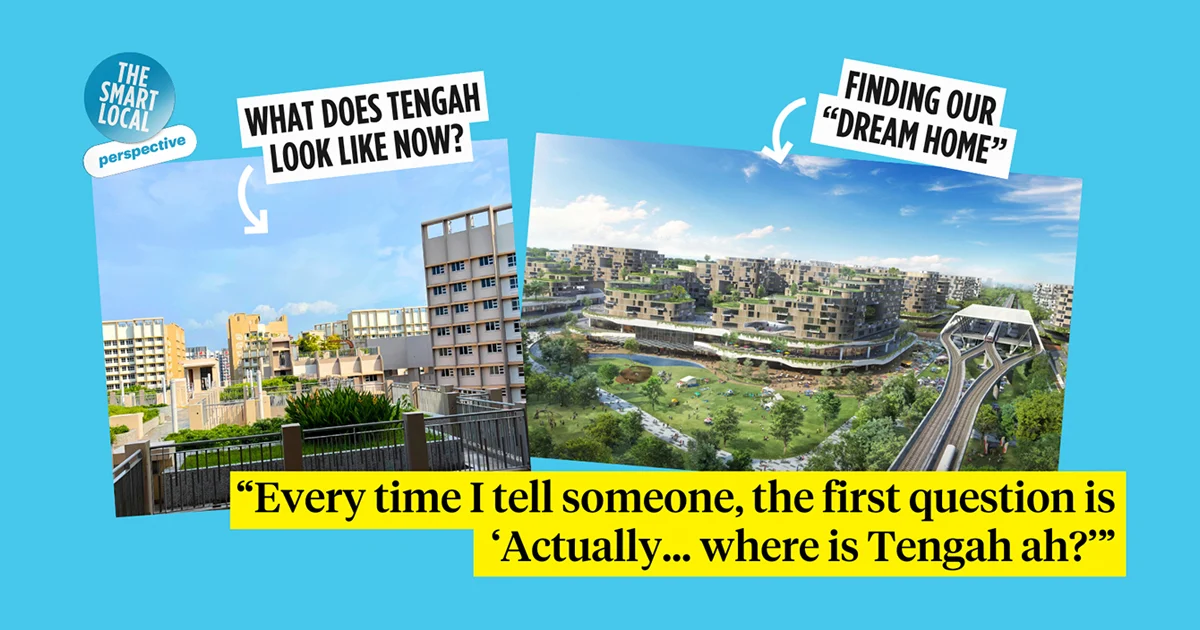

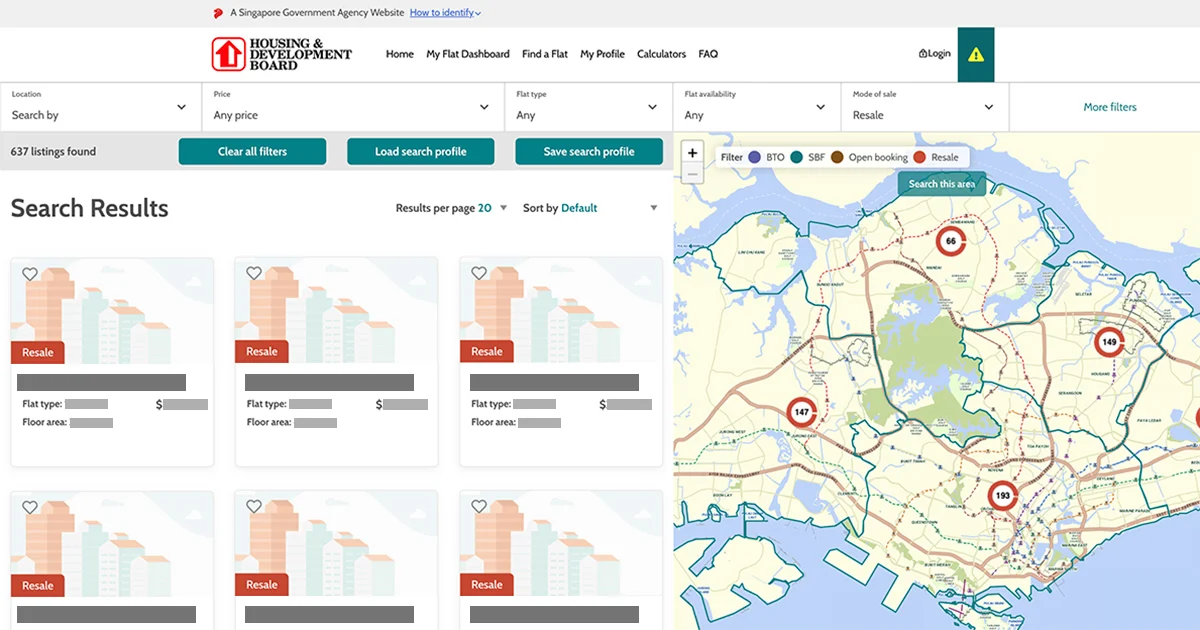

You can visit the HDB Flat Portal to check out the BTO projects scheduled for the next sales launch, including the site map, flat types and approximate number of units offered for each project.

However, more details, such as the application period, will only be announced on the day of the sales launch. Be sure to follow HDB’s social media channels @SingaporeHDB for the latest news!

During a sales launch, you will see a banner (like the one pictured below) on the HDB Flat Portal. Click on it and it will lead you to a listing page with prices and information on the projects on offer. Be sure to go through the details and discuss the options with your co-applicant!

Step 4: Submit application

In a typical sales launch, you will have one week to submit your application. There’s no need to rush as applications are not processed on a first-come-first-serve basis.

After applications close, HDB will process the BTO applications using a computer ballot. This will determine your queue position to book a flat.

? The bulk of HDB’s BTO supply is set aside for first-timer families, with more help for buyers under the First-Timer (Parents & Married Couples) category from the next Sales Launch in end September/ early October 2023. You can improve your chances further by applying under one of HDB’s Priority Schemes.

Step 5: Receive application outcome

HDB will notify you on the outcome of your ballot via email, within 2 months after the close of application.

Step 6: Book flat

If your application is successful, you will be invited to book a flat from 4 weeks after the release of the ballot results. Before you head down to HDB Hub at Toa Payoh for your appointment, be sure to have the required documents ready.

During the selection appointment, you will need to pay an option fee – this will form part of your downpayment for the flat purchase. The amount you would have to pay depends on the flat type. Payment has to be made via NETS.

| Flat Type | Option Fee |

| 4/5 room Executive | $2,000 |

| 3-room | $1,000 |

| 2-room Flexi | $500 |

? You can create a watchlist of your preferred units on the HDB Flat Portal and receive notifications if/ when they have been booked by others.

Step 7: Sign Agreement for Lease

From 6 months after booking your flat, HDB will invite you to sign the Agreement for Lease. Ensure that you have the necessary documents with you.

You would also need to make a downpayment for your flat and the amount depends on the type of loan you are taking:

- For an HDB housing loan, the downpayment is 10% of the purchase price. It can be fully paid for using your CPF Ordinary Account (OA) savings.

- For a loan from an FI, the downpayment is 20% of the purchase price, of which at least 5% must be paid using cash. The remaining can be paid using your CPF savings. As the maximum loan quantum granted by financial institutions is 75% of the purchase price, you will have to pay the balance 5% of the purchase price using cash or CPF savings when you collect the keys to your flat. The actual cash quantum would depend on the maximum loan ceiling.

For payment using CPF savings, you would need to access your Singpass and your mobile phone. Note that the registration for Singpass and activation of 2FA can take up to 10 working days, so be sure to prepare these in advance!

Step 8: Collect keys to flat

When your flat is ready, HDB will let you know when you can collect your keys. The key collection process is straightforward – be sure to have the necessary documents with you.

Look out for the photobooth at the Sales Atrium and be sure to take a shot with your keys. Tag us at @SingaporeHDB and we might just feature your happy snap on our socials.

Congratulations on becoming a home owner!

? Planning for your home renovation is a creative process which takes time! Start early with this Guide to Planning Your HDB Home Renovation.