While the Build-to-Order (BTO) exercise is the most common way for home buyers to purchase a new flat, there are other sales modes for them to consider – one of which is the Sale of Balance Flats (SBF) exercise.

One of the main reasons why people choose to apply for SBF instead of BTO flats is the relatively shorter waiting time. As its name suggests, many of the flats sold under the SBF exercise are balance flats remaining from earlier BTO sales launches. These units are either undergoing construction, or already completed. While SBF is definitely an option to consider, here are some things to take note before you submit your application.

1. Flat Information Made Available During Sales Launch

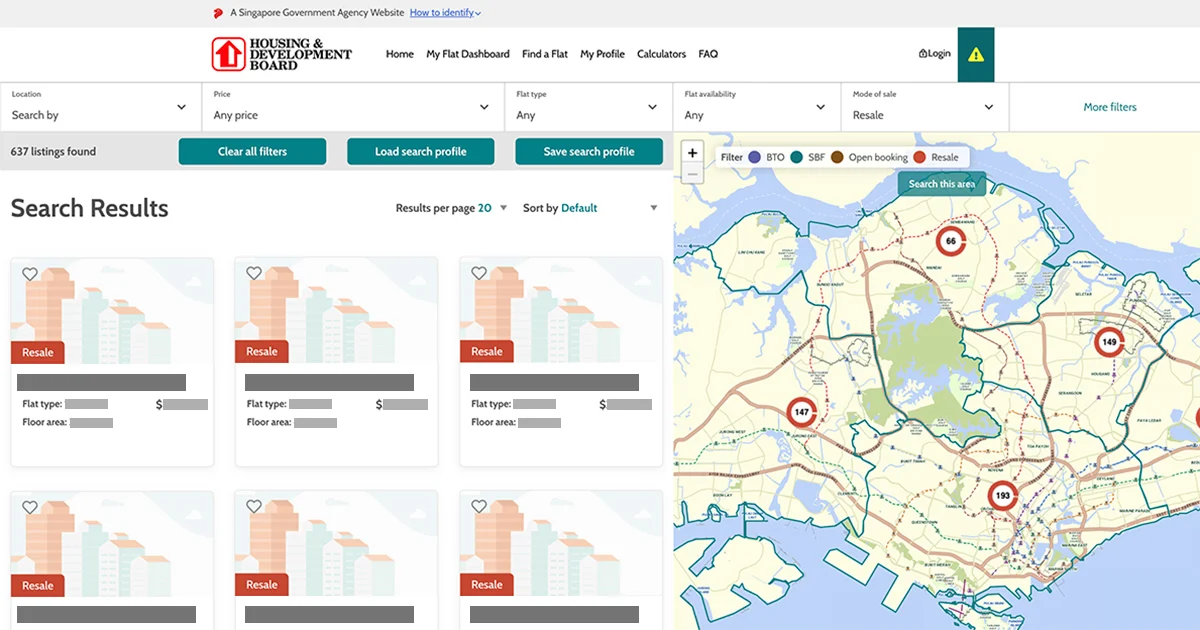

SBF comprises a variety of flat types located across different estates. In the last SBF exercise in May 2021, popular estates like Bishan and Bukit Merah were included as well.

Information about the available flats is released during the sales launch. These include the flat type, location and number of units available. Home buyers will have to select a flat and submit the application for the SBF exercise within the application period.

2. Flat Leases Can Vary

While the vast majority of SBF units are new flats left over from previous sales launches, the selection also comprises older flats such as surplus flats from Selective En Bloc Redevelopment Scheme (SERS) projects, and flats repurchased by HDB from previous owners. You’ll need to consider the lease length when choosing to purchase a flat from the SBF exercise.

3. CPF Housing Grants Are Applicable

As with BTO flats, home buyers can enjoy CPF housing grants such as the Enhanced CPF Housing Grant (EHG) of up to $120,000 and the Step-Up CPF Housing Grant of up to $15,000, depending on eligibility. More details on CPF housing grants in our guide.

4. Demand Has Seen an Increase

Application rates have remained high for SBF flats as the shorter waiting time makes them popular among buyers, so do keep that in mind when considering SBF over BTO. As there is usually a smaller number of SBF flats available as well, your chances of successfully applying for a flat will vary.

Should You Opt for SBF?

The SBF exercise is a good option for home buyers looking to shorten the waiting time for a flat. This sales mode also offers more flexibility in terms of choice, thus suiting home buyers with specific housing needs. However, home buyers who are looking to move into their flats sooner may want to consider resale flats.

This article was adapted from 99.co, Singapore’s fastest growing property platform for information like resale HDBs for sale and rent in Singapore. Check out the original article on 99.co.